Welcome to Frontier Markets Ideas by Me

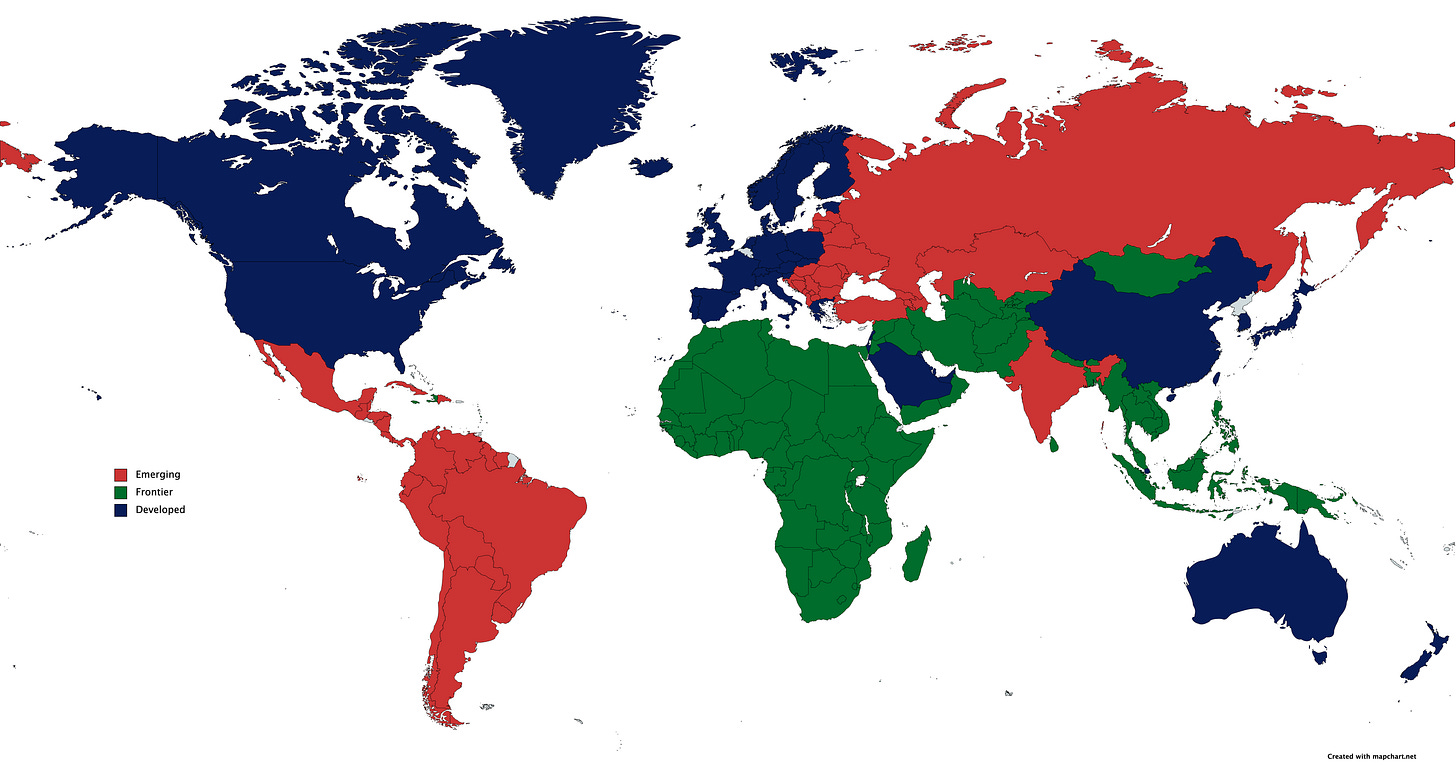

My goal via this substack is to explore and expand interest in public equity investing in the global economies most people overlook, the so-called “Frontier Markets”. To a lesser extent, I will discuss companies in the “Emerging Markets”. Different data collators and publishers define different countries in different ways, and there is grey area between “Frontier” and “Emerging”, but I tend to define it in three categories: Developed, Emerging, and Frontier. For the sake of this project, I do not view “Developed” to necessarily be any hard-line descriptor of health, wealth or prosperity; rather, it takes into account a heavy weighting of capital markets access (notice China in Developed). The green parts of this map will be the focus:

For comparison, MSCI defines their markets this way:

Notice there are many countries they do not even bother to include. We will try to explore those countries too. If you would like to know more about MSCI’s classifications, go here.

What this Letter is

As a reader, you will receive once or twice a month:

A public equity idea with a majority of their business located in one of these geographies

A Macro story or write-up about one of these geographies (when permitting)

I hope that in the future I will be able to write-up two ideas per month, one listed on an exchange located in a “Developed” capital market (i.e. NYSE, LSE) and one listed in the home country of the business. I wish to take investors off the beaten path in search of high quality businesses in geographies that make people cringe. If the reader has never heard of the company discussed prior to the letter, I am succeeding!

If any of the above interests you, I would be grateful for your subscription.

What this Letter is NOT

I will not be exploring India or China in this letter. There are arguably more analysts covering stocks in India than stocks in the United States. However, the capital markets success of India and China will be used as guides in uncovering economies that are coiled to boom.

I will try not to pitch natural resource companies in this letter. The Frontier world is often associated with these types of businesses. As a value investor, if I see a natural resource company trading at a ridiculously cheap price, of course I will dig deeper. However, my goal is to apply traditional value investing frameworks to uncover businesses that have the potential to compound over a long period of time as these economies develop. I want to learn about businesses that are helping economies grow and develop for their local populations, rather than exploiting them for Westerner’s benefit.

Disclosures and Disclaimers

Frontier Market Ideas is not investment advice. Any assertions made in Frontier Market Ideas represents the author’s opinion. The author may or may not have positions in companies written about in Frontier Market Ideas, specified in each individual write-up.